Accurate tracking ensures that any price difference evaluation reflects true production costs. Effective management of direct material variance can lead to significant savings and better resource allocation. It also helps identify inefficiencies within the supply chain or production process that may otherwise go unnoticed.

Direct Materials Quantity Variance Calculator Online

Whether it’s to pass that big test, qualify for that big promotion or even master that cooking technique; people who rely on dummies, rely on it to learn the critical skills and relevant information necessary for success. If items are needed quickly and ordered on a rush, the cost may be higher. Our mission is to empower readers with the most factual and reliable financial times interest earned ratio calculator pricing strategy consultant information possible to help them make informed decisions for their individual needs. For information pertaining to the registration status of 11 Financial, please contact the state securities regulators for those states in which 11 Financial maintains a registration filing. Both formulas give the same answer so feel free to use whichever seems easier to you.

- After figuring out how much material you used, it’s time to look at the prices.

- Because the company uses 30,000 pounds of paper rather than the 28,000-pound standard, it loses an additional $20,700.

- Another advanced technique is the application of statistical methods, such as regression analysis, to understand the relationship between different variables affecting material costs.

- However, it’s essential to consider other factors that may influence costs, such as changes in material quality or production processes, when interpreting variance results.

About Dummies

Our work has been directly cited by organizations including Entrepreneur, Business Insider, Investopedia, Forbes, CNBC, and many others. Our team of reviewers are established professionals with decades of experience in areas of personal finance and hold many advanced degrees and certifications. 11 Financial may only transact business in those states in which it is registered, or qualifies for an exemption or exclusion from registration requirements. 11 Financial’s website is limited to the dissemination of general information pertaining to its advisory services, together with access to additional investment-related information, publications, and links.

Would you prefer to work with a financial professional remotely or in-person?

Therefore, the purchase cost of the entire quantity must be compared with the standard cost of the actual quantity. The actual price must exceed the standard price because the material price variance is adverse. A solid grasp on them helps in maintaining tight cost control over materials procurement. It tracks if spending goes as planned or if there are surprises needing attention. After figuring out how much material you used, it’s time to look at the prices. You need to know both the budgeted price and what you actually paid for each unit of material.

By delving into the specifics of variances, companies can uncover inefficiencies and make informed decisions to optimize their operations. The first step in this analysis is to regularly review variance reports, which provide a snapshot of how actual costs compare to standard costs. These reports should be detailed and timely, allowing managers to quickly identify and address any discrepancies.

This is offset by a larger unfavorable direct materials price variance of $2,520. The net direct materials cost variance is still $1,320 (unfavorable), but this additional analysis shows how the quantity and price differences contributed to the overall variance. This variance helps businesses understand how efficiently they are managing their material costs and can highlight areas where cost control measures may be needed. The standard cost of actual quantity purchased is calculated by multiplying the standard price with the actual quantity.

Learn how to calculate, analyze, and apply direct material variance for effective cost control and improved financial performance. We’ll also include examples to display the process of calculating your direct material price variance. The manager may try to overstate it to protect himself from being punished if something goes wrong during the production (unexpected waste or error). Our selling price is higher than the competitors and for sure it will impact the sale quantity. An adverse material price variance indicates higher purchase costs incurred during the period compared with the standard. Now that we have understood the direct material price variance calculation, let’s look at how to interpret it.

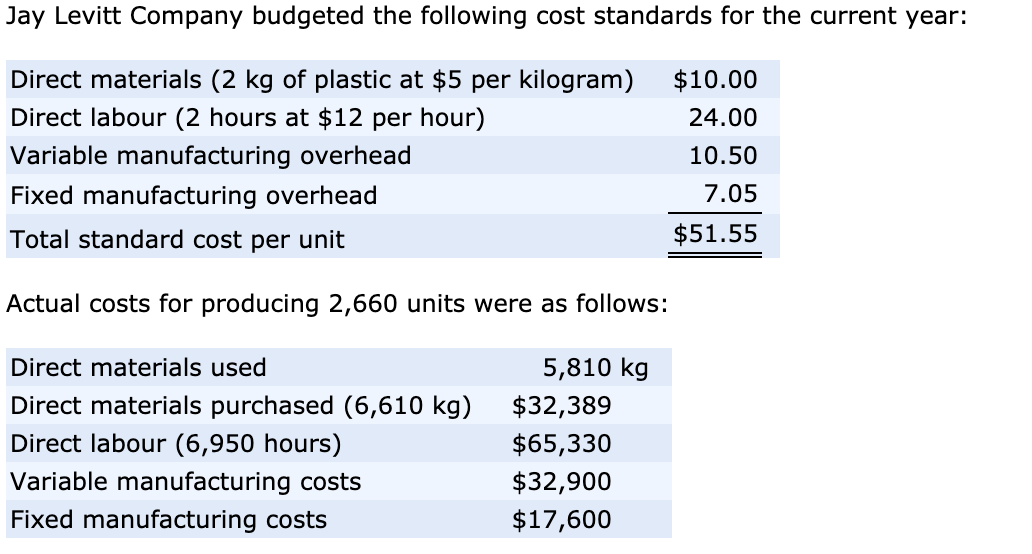

It is one of the variances which company need to monitor beside direct material usage variance. To begin with, calculating direct material variance involves comparing the standard cost of materials to the actual cost incurred. This comparison helps businesses understand whether they are spending more or less than anticipated on raw materials. The standard cost is typically derived from historical data, industry benchmarks, or predetermined budgets, while the actual cost is recorded during the production process.

Direct Material Price Variance is the difference between the actual cost of direct material and the standard cost of quantity purchased or consumed. Direct materials price variance account is a contra account that is debited to record the difference between the standard price and actual price of purchase. Sometimes companies have trouble figuring out the direct material price variance. Looking closely at these causes helps managers make better choices in the future. They can find ways to keep costs down and make sure they use resources well.

The difference column shows that 200 fewer pounds were used than expected (favorable). It also shows that the actual price per pound was $0.30 higher than standard cost (unfavorable). The direct materials used in production cost more than was anticipated, which is an unfavorable outcome. The direct materials quantity variance of Blue Sky Company, as calculated above, is favorable because the actual quantity of materials used is less than the standard quantity allowed.

Material variance is the difference between the actual cost of direct materials and the expected cost of those materials. Direct materials quantity variance is also known as direct material usage or volume variance. The difference between the standard cost (AQ × SP) and the actual cost (AQ × AP) gives us the material price variance amount. You multiply the actual quantity of materials bought by the difference between standard and actual price per unit. The following equations summarize the calculations for direct materials cost variance. The valuation of stock on standard cost basis implies that the entire effect of any price variance is to be accounted for in the current period.