Numerous apps declare to offer you immediate cash advancements, in add-on to several of which we’ve tested reside up to that state. We’ve already been able in buy to obtain money within our own lender account much less compared to ten moments after downloading typically the app! Regarding program, inside nearly each case you’ll pay additional with respect to that conveniences, with express costs of which can add quite a bit to the particular cost of borrowing a few of bucks.

Methodology: How We All Chose These Kinds Of Providers

Furthermore, it may end upward being appealing to depend about the app to entry your own earned cash early on, which often may come to be a negative habit in case you’re not really careful. Varo is usually borrow cash app a monetary organization that offers cash advances of upwards to $500 in order to their clients. The Particular greatest portion will be that these people don’t demand tips or attention payments. As An Alternative, an individual pay a flat payment dependent upon the particular advance sum, in inclusion to you pay off it about your current following payday. In Case an individual may’t pay a payday mortgage, you could get out there an additional to become able to pay back the particular 1st. In Case a person may’t pay off that will, an individual can borrow again or renew, typically paying a restoration charge every time.

Happy Cash Individual Financial Loan Overview: Low-fee Credit Score Cards Debt Consolidation

When it arrives to become capable to selecting a funds advance software, there are several choices in purchase to pick through. Typically The loan amounts are usually relatively tiny, in addition to the particular repayment windowpane is usually limited to thirty five days and nights. Likewise, the particular optional suggestions and donations can put in order to the price of the financial loan if a person pick in buy to contain these people. Instant financing accessible along with Turbo Fees or twenty four to 48 several hours regarding MoneyLion looking at bank account users; 2 to five business days with consider to nonmembers.

Honor Successful Support

It’s not necessarily a good thought to be capable to get within the particular behavior of applying cash advance applications, nevertheless sometimes it’s necessary. Just Before choosing this option with regard to your current funding needs, learn typically the pros in inclusion to cons regarding money advance apps. The Particular software guarantees earlier paychecks, simply no hidden charges, plus charge cards advantages, amongst other functions. An Individual also get cost safety, wherever you’ll get a reimbursement associated with upwards in order to $250 if an individual look for a lower price for anything an individual acquired within just 90 days and nights with your own MoneyLion Charge Mastercard®. A Person could obtain your own funds advance typically the same time using the particular express alternative. Nevertheless, ensure that will typically the charge is lower compared to any sort of fees and penalties incurred with respect to virtually any late payments with respect to which usually you’re borrowing the cash.

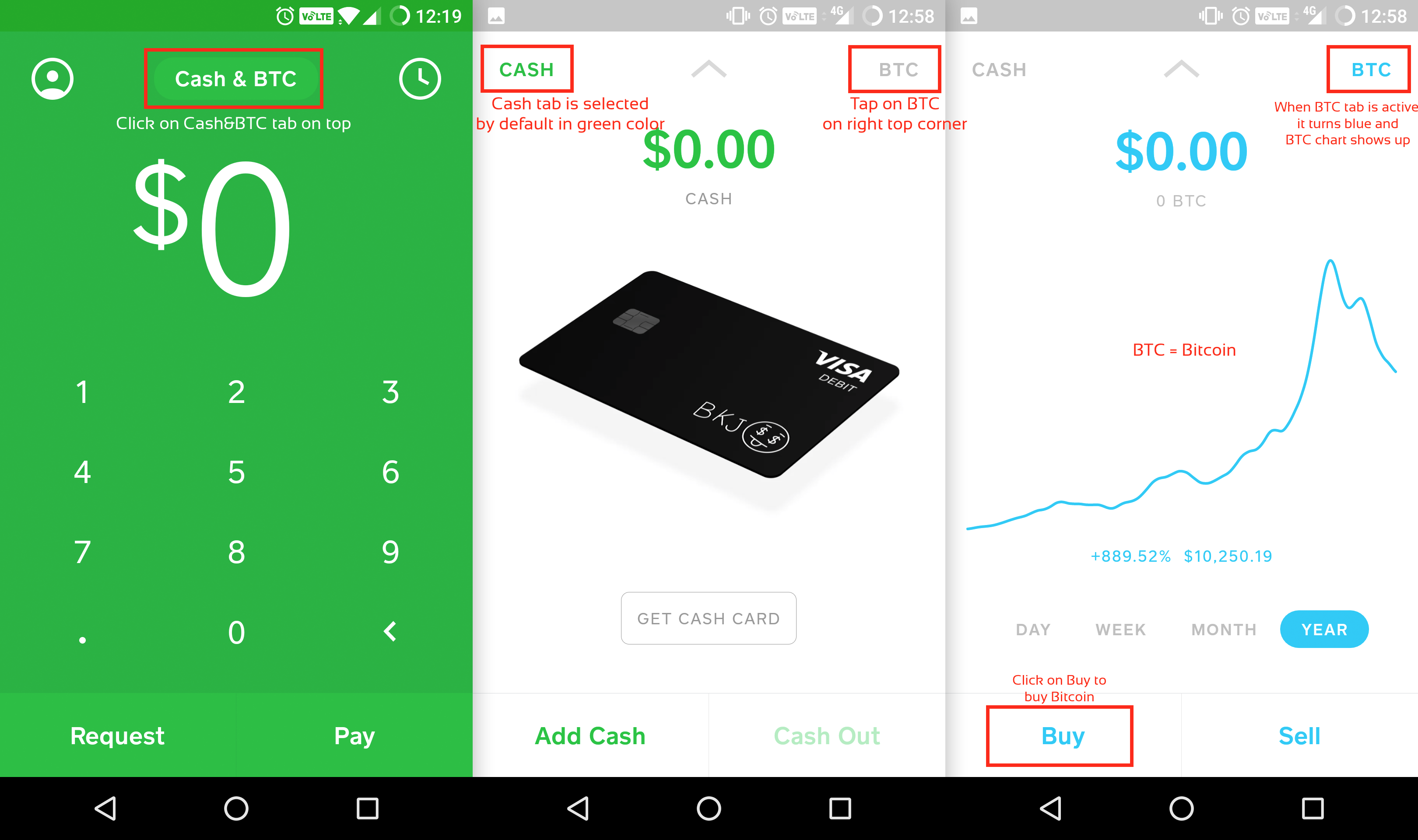

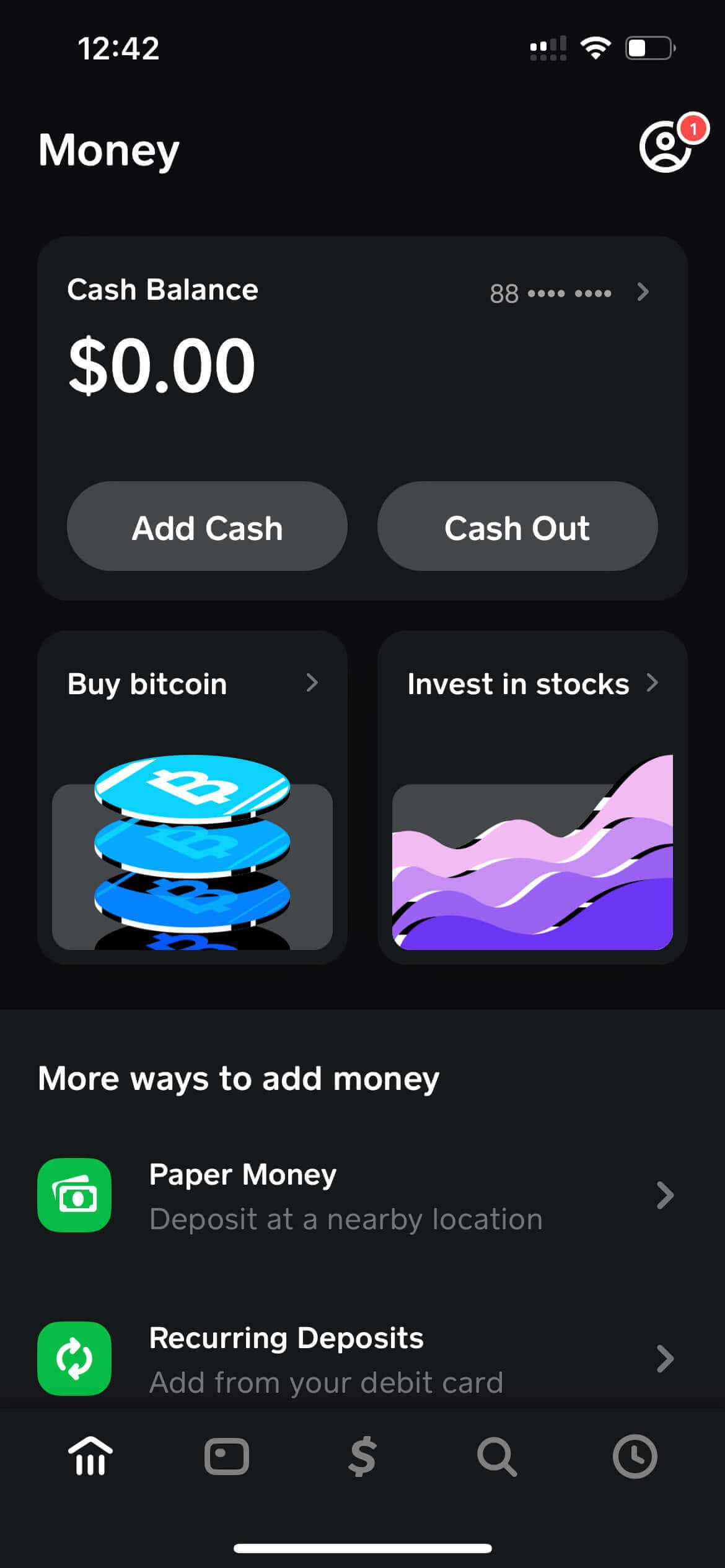

MoneyLion contains a regular membership enterprise design with respect to their “InstaCash” alternative, which usually provides a fee-free advance associated with upwards to become in a position to $250 till payday. Cash advance apps should be mindful of your own pay period and income amount. In Case you want to become capable to entry your current direct downpayment along with Money Software plus want in order to link your current Cash Application account to Funds Advance apps, it may possibly change out lost. A Few Funds App account cases could borrow funds directly from Money Software through the Money Application Borrow characteristic.

Greatest Funds Advance Applications Inside 2025

It could help you cover unpredicted costs in inclusion to keep afloat till payday. 1 of typically the major functions associated with Cleo is that it could offer a person up to $250 being a cash advance, together with no credit rating verify or interest charges. However, when this is your current 1st period applying this characteristic, the particular limit is set at $100. One regarding the rewards of using Varo will be that money improvements of $20 or less have simply no costs.

In this specific blog write-up, we all will discover several associated with the particular finest cash advance apps that will function along with Money App. When your own company lovers with Payactiv, that’s your greatest bet with consider to low-fee accessibility in order to your current attained wages. In Case an individual may employ typically the some other equipment offered together with the Enable app, the membership charge may possibly end upward being worth it with respect to you. Typically The same goes with consider to Dave—we particularly just like the particular in-app aspect hustle options.

- Repayment will be automatic, nevertheless Dave will in no way overdraft a customer’s accounts, therefore an individual don’t possess to be concerned regarding virtually any added charges coming from your own bank.

- It’s not necessarily a great thought in purchase to acquire in the behavior of applying funds advance apps, but occasionally it’s required.

- These People may have got money help or foods stamps to help households inside want.

- These Types Of payday advance applications mostly acknowledge traditional banking institutions because these people may authenticate transactions together with Plaid plus confirm your current history associated with a secure income.

- All Of Us recommend EarnIn as typically the best software since it has the greatest advance limit and no required fee.

- This Specific application moves over and above lending by supplying choices for investing in inclusion to cryptocurrency buying and selling.

Applications Just Like Dave With Consider To Little Cash Advancements In 2025

We All have a list associated with 9 funds advance programs of which several associated with an individual may possibly previously realize. These People help to make it effortless to end up being able to borrow cash regarding a short whilst without trouble. You don’t need a Cash App account, nevertheless having each could be useful.

A Number Of cash advance apps have manufactured it less difficult as in comparison to ever in order to borrow tiny sums while adding easily with your current Funds Software accounts. Cash advance apps give a person entry to end upwards being capable to cash just before your payday, providing a a lot more affordable option to be in a position to traditional bank overdraft services, which often arrive along with high costs. Instead regarding counting upon high-interest loans, these sorts of apps make use of voluntary ideas or flat charges like a earnings supply. Several personal loan companies have a speedy acceptance process in inclusion to may possess funds to become able to a person in simply a couple of company days or also the particular similar company time if you are qualified. Prior To borrowing, become mindful regarding typically the loan APR plus any origination or additional costs.