Mastering the Art of Trading: Strategy Pocket Option

In the realm of online trading, having a solid strategy is essential for success. One platform that has garnered attention from traders worldwide is Pocket Option. This platform not only offers a user-friendly interface but also a variety of trading options that can fit any trader’s needs. In this article, we will delve into the Strategy Pocket Option, exploring some effective approaches and tips for maximizing your trading experience. For more detailed insights on strategies, you can visit Strategy Pocket Option https://pocket-option-help.ru/blog/strategija/.

Understanding Pocket Option

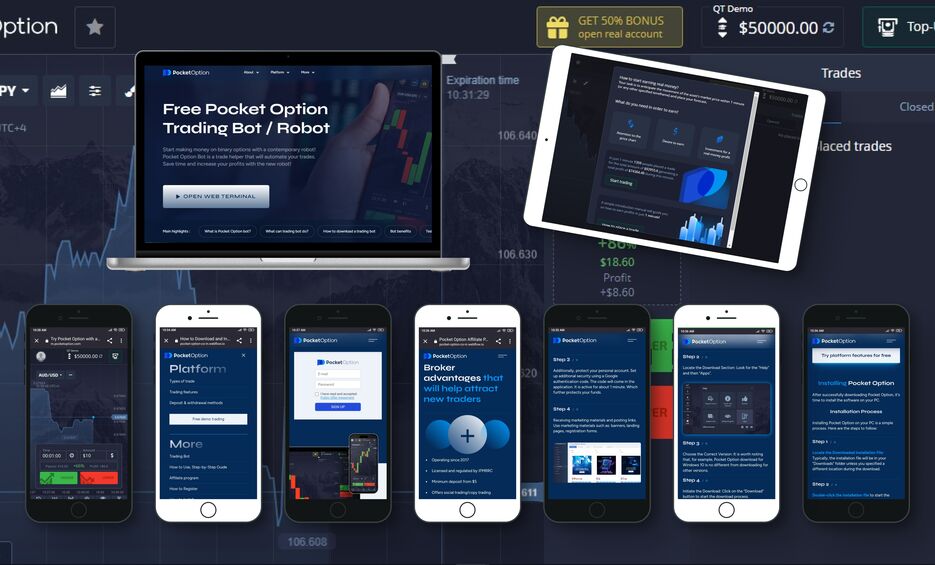

Pocket Option is a binary options trading platform that provides users with the opportunity to trade a wide range of assets, including currencies, cryptocurrencies, commodities, and stocks. Launched in 2017, Pocket Option quickly became a popular choice for both novice and experienced traders due to its unique features and trading charts.

One of the standout features of Pocket Option is its demo account, which allows new traders to practice without any financial risk. This feature enables traders to familiarize themselves with the platform’s tools and strategies before venturing into real-money trading.

The Importance of a Trading Strategy

A trading strategy is essentially a set of rules that govern your trading decisions. Having a well-defined strategy can help you manage risks, optimize profits, and maintain emotional discipline. Without a strategy, traders often fall prey to impulsive decisions based on emotions rather than logic.

The market is highly volatile and unpredictable, which makes the need for a strategic approach even more critical. A good strategy will not only help you make informed decisions but also enable you to analyze market trends and patterns effectively.

Basic Strategies for Pocket Option

1. Trend Following

Trend following is a popular strategy that revolves around identifying the direction of market trends. The concept is straightforward: buy when the market trends up and sell when it trends down. Traders often use various technical indicators, such as moving averages and the Relative Strength Index (RSI), to confirm the presence of a trend.

2. Range Trading

Range trading is utilized when a trader identifies a price range where an asset is trading. The strategy involves buying at the support level and selling at the resistance level. This method relies on the assumption that the asset’s price will bounce between these two levels.

3. News Trading

News trading entails making trading decisions based on the impact of news events on the financial markets. Economic announcements, earnings reports, and geopolitical developments can significantly influence market conditions. Traders who adopt this strategy must stay informed and be able to react quickly to news releases.

Advanced Strategies for Experienced Traders

1. Martingale Strategy

The Martingale strategy is a high-risk, high-reward system often used in binary options trading. It involves doubling your investment after a loss with the belief that, eventually, you will win and recover all previous losses. While this strategy can yield impressive results in the short term, it comes with significant risks that can lead to substantial losses.

2. Fibonacci Retracement

The Fibonacci retracement strategy is based on the Fibonacci sequence, a mathematical concept that highlights the natural ratios present in various aspects of life, including financial markets. Traders use Fibonacci levels to determine potential support and resistance levels, making it a valuable tool for predicting market reversals.

3. Price Action Trading

Price action trading focuses on the historical price movements of an asset and disregards indicators. Traders analyze price charts to identify patterns and trends, using this information to make informed trading decisions. This strategy requires a strong understanding of market psychology and price dynamics.

Risk Management Techniques

Regardless of the strategies you choose to implement, risk management should always be a priority. Here are some essential risk management techniques you can apply while trading on Pocket Option:

- Set a Budget: Determine how much capital you are willing to risk on each trade and stick to that limit.

- Use Stop-Loss Orders: A stop-loss order can help you minimize potential losses by automatically closing a position when it reaches a specified price.

- Diversify Your Investments: Avoid putting all your capital into a single trade or asset. Diversification can help spread risk.

- Keep Emotions in Check: Trading can be emotionally charged. Always follow your strategy and avoid making decisions based on fear or greed.

Conclusion

Trading on Pocket Option can be a rewarding endeavor if approached with the right strategies and mindset. By understanding the different trading strategies available, including both basic and advanced techniques, and implementing solid risk management practices, traders can enhance their chances of success.

As the trading landscape continues to evolve, adapting your strategies and remaining informed about market trends and developments will be crucial for sustained success. Whether you are a beginner or an experienced trader, the key to successful trading lies in continuous learning and strategic planning.